The COVID-19 crisis triggered, and in many cases, worsened external liquidity constraints of developing countries. Market conditions deteriorated, making it difficult – and sometimes, impossible– for them to raise funds from commercial sources. Moreover, investor preference for safe haven assets at the peak of the crisis provoked massive capital outflows from developing countries. This was worsened by a global collapse in tourism, a fall in commodity prices and shrinking foreign currency revenues. Under these circumstances, developing countries needed to access short-term emergency liquidity provision. However, sufficient, timeous and adequate resources were not always available to them.

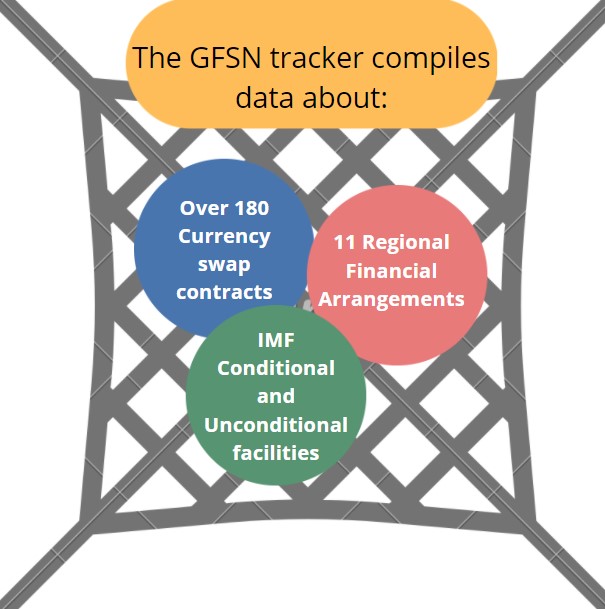

The GFSN tracker (www.gfsntracker.com) is an innovative tool set up by the Institute for Latin American Studies at Freie Universität Berlin and the Global Development Policy Center at Boston University, with the support of UNCTAD. It identifies, on a monthly basis, the most relevant sources of short-term liquidity for all UN member countries at the global, regional and the bilateral level, including:

(i) historical lending capacity of the IMF and RFAs (regional financial arrangements) between 2018 and 2021;

(ii) borrowing agreements with the IMF, RFAs and any bilateral currency swap agreements subsequent to the onset of the COVID-19 pandemic in February 2020, irrespective of whether the agreed funds were indeed drawn.

The GFSN tracker:

- Allows each UN member state to know its relative position in terms of short-term liquidity provision regarding scale and emergency financing alternatives. This is particularly useful for the most vulnerable developing countries during the Covid-19 pandemic.

- Contributes to the UN long-standing role as democratic space for discussion of reforms in the International Financial Architecture since it exposes gaps and inequities of the current GFSN, with member states from Sub-Saharan Africa, the Middle East & North Africa, and Latin America and the Caribbean having access to the least amount of liquidity provision.

- Fills an important gap in the understanding of the GFSN’s coverage and features that can help policymakers, international organizations, civil society organizations (CSO), think tanks, and researchers to analyze the opportunities, risks and changes of the GFSN in the future.